PROSPECTUS

Presented by Richard Ainsworth-Morris

Table of Contents

1. Introduction............................................................................................3-5

2. The Project.............................................................................................5-10

3. Summary.................................................................................................11

4. Company Structure and Directors.......................................................12-13

5. Financial Scheduling and Projections.................................................13-24

6. Appendix 1 – Incbio Plant Specifications............................................25-29

7. Appendix 2 – Risk Assessment............................................................30-34

List of Tables

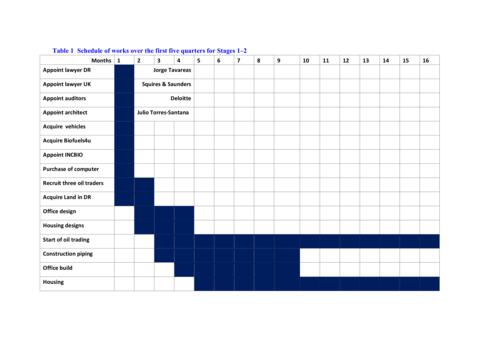

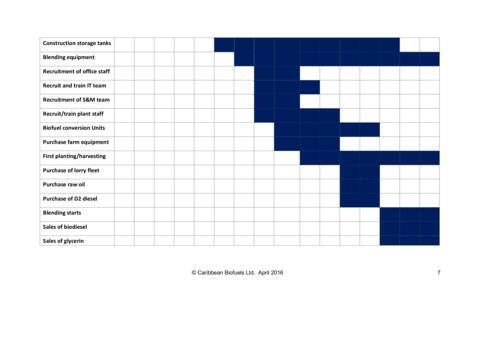

1. Schedule of works over the first five quarters...................................7

2. Breakdown of land use.........................................................................8

3. Breakdown of expenditure in US$ millions........................................11

4. Workforce requirements......................................................................11

5. Year 1 cash flow projections...............................................................15-17

6. Year 2 cash flow projections...............................................................18-20

7. Year 3 cash flow projections...............................................................21-23

List of illustrations

1. Location of operations..........................................................................9

2. Port of Pepillo Salcedo and existing oil tanks....................................10

1. Introduction

The Dominican Republic (DR) does not have any recognized hydrocarbon deposits and, as a result, has to import all of its fuel requirements, thus using up scarce foreign currency reserves. The country needs

to become less dependent on imported hydrocarbons for powering its electricity plants and for manufacturing and transport, as well as for private motoring. Recognizing this, in 2008 the Government passed Decree 202-08, to promote the development of renewable sources of energy (http://repository.unm.edu/handle/1928/14301).

Although the recent dramatic fall in crude oil prices will have a beneficial effect in the short term, as a result of its policy of controlling fuel prices the Government will still have to use valuable reserves of foreign exchange to ensure some form of fuel-price stability. In February 2015, the Government of President Danilo Medina called for investment in refinery capacity to reduce the Republic’s dependence on imported fuel (http://almomento.net/venezuela-podria-vender-49-deacciones-en-refineria-dominicana/).

Given the dependence on imported hydrocarbon fuels, thus on international market pricing, the inflationary targets set by the Central Bank of 4.5%, currently around 2.7% (January 2015: http://www.tradingeconomics.com/dominican-republic/inflation-cpi) are always going to be affected by factors beyond its control. We believe that these pressures can be alleviated if the country develops its own fuel production strategy, and Caribbean Biofuels Ltd. offers this opportunity with its plans to establish a major biofuel production facility in DR.

Biodiesel is made by combining alcohol (usually methanol) with vegetable oil, animal fat, or recycled cooking grease. It is a non-toxic and biodegradable energy source that produces lower levels of air pollutants. Most often it is blended with petroleum diesel in ratios of 2% (B2), 5% (B5),20% (B20), or sold as pure biodiesel (B100). Biodiesel fuels can be used in regular diesel vehicles without making any changes to the engines and is the fastest-growing alternative fuel.

Biodiesels produce significantly lower quantities of pollutants (unburnt hydrocarbons, carbon monoxide, and particulates) than conventional diesel from fossil hydrocarbons. Further, emissions of sulfates and sulfur oxides, major components of acid rain, are effectively eliminated. Fuel efficiency drops marginally with pure biodiesel (in the region of 3-4%: http://www.epa.gov/otaq/models/analysis/biodsl/p02001.pdf), but this is more than compensated for by price and environmental impact.

Brazil and Mexico (http://www.reuters.com/article/2015/03/19/us-mexico-pemex-biofuelsidUSKBN0MF2SS20150319) provide excellent examples of the benefits of such a policy. Both are producers and users of biofuels including biodiesel and ethanol and are pursuing the expansion of solar energy exploitation. As a result, they have seen marked reductions in hydrocarbon imports and changes in usage, with significant economic effects. Further, there have been substantial improvements in levels of pollution. These benefits will be available to DR through the work of Caribbean Biofuels Ltd. Total Brazilian ethanol production for 2015 is projected at 26.9 billion liters, a 5% increase compared to 2014. Ethanol exports are forecast at 1.8 billion liters, up 200 million from the current year. The biodiesel industry remains regulated by the government which recently increased biodiesel blend requirements to 6% effective July 1, 2014, and 7% effective November 1, 2014. As a consequence, biodiesel production for 2015 is projected at 4.4 billion liters, up 900 million liters from 2014.

DR is a producer and exporter of palm oil that can be converted to biodiesel. Rapeseed oil, priced somewhat lower, can also be processed to produce biodiesel, and costs can be reduced further by the local growing of rapeseed and other oil-stock crops, something that forms a key element in the company plans.

Although oil prices fluctuate in the spot market for oil, with an oil price above US$50-60 a barrel production provides good return (see, for example, Eidman, V.R. (2007) ‘Economic

Parameters for corn ethanol and biodiesel production, Journal of Agriculture and Applied Economics 39(2), 345–356 which discussed parameters at a time when crude oil was at $60 per barrel). With the subsequent falls in raw material prices, a much lower crude oil price can be tolerated.

Caribbean Biofuels Ltd. will be in a strong position to take advantage of the recent recovery in oil prices when the first plant is commissioned and starting to produce by the middle of 2016.

The company will sell pure product to those consumers whose engines can run on it, while others will be supplied with different blends of biodiesel with conventional diesel, these blends include examples:

x B20 which is 20% biodiesel, the other 80% being diesel or kerosene, other blends with a higher biodiesel content can be produced as required Biodiesel can also be blended with D2 which is Ultra-low-sulfur diesel ULSD (but this is more necessary for colder climates, not essential for the DR)

x Ethanol may also be used in special engines by mixing with petrol and is called Gasohol (7090% petrol and 10-30% ethanol). Currently, a blend of 10% ethanol (or up to 3% of Methanol and 7% Ethanol) and 90% gasoline called E10 is approved for use in all vehicles in the EU. For the local DR government, the benefits of the Caribbean Biofuels Ltd. project to the national economy can be summarised as follows:

1. Lessening of the need for Government intervention to stabilize fuel prices, hence reduction in the outlay of foreign currency;

2. Reduction in levels of pollution from engine emissions. Production of biodiesel is carbon neutral;

3. DR will become a net exporter of biofuel, and dependence on imported fuel – currently at levels around 500 million US gallons per year – will be reduced significantly;

4. Production will provide significant tax revenues for the Government, as well as reducing, then eliminating, power blackouts by reducing and stabilizing energy production costs.

For Caribbean Biofuels Ltd., the main markets within DR for the fuel are:

1. Sugar cane mills;

2. Road stock covering logistics, domestic users, and bus operators;

3. Manufacturing corporations, including processes and generating plant;

4. Individuals who are now purchasing dual-fuel vehicles where the cost of vehicle propane is already at US$ 3 per gallon and increasing;

5. Electricity generators.

The market for Biofuel in the DR is substantial and the rewards for the first large-scale operation established will be significant. In 2013, there were some 5.8 million vehicles on the road of which

1.16 milion (20%) ran on diesel (source: Dominican Republic Ministerio de Industria y Comercio). In 2013, diesel consumption, including power generation, industry, and transport, was some 330 million US gallons (http://www.seic.gov.do/sobre-el-mic.aspx), all imported. Switching to blended biodiesel will reduce this progressively, with projected savings to the consumers.

A by-product of the transesterification of fats and oils processing is crude glycerin, a raw material in the manufacture of products such as animal feed, polyester resin, and cosmetics. Glycerin is a byproduct of biodiesel production, and a proportion of costs will be offset through the sale of glycerin on the world market. Currently (January 2015) bulk refined glycerin wholesales between US$600-700 per metric ton, and the production of 10 tonnes of biodiesel will yield approximately 1 tonne of glycerin.

The company will become a net exporter of biodiesel throughout the Caribbean within five years, and an exporter of refined glycerine within two years.

In the short term, Caribbean Biofuels Ltd. will also look at opportunities to increase sales of biofuels in the DR for example to import from other countries: for example, in recent years Argentina has produced significant volumes of biodiesel, which was largely exported to Europe (1.15m tonnes in 2013). Following tariffs imposed by the EU in 2013 (on the basis that 'low-price' imports were damaging to European biodiesel producers), exports from Argentina were predicted to plunge by 39% in 2014 [Source: Argentina Biofuels Chamber (Carbio)]. The company would also consider the importation of supply in the short term to increase market share pending the local manufacturer scaling up to meet the demands.

2. The Project

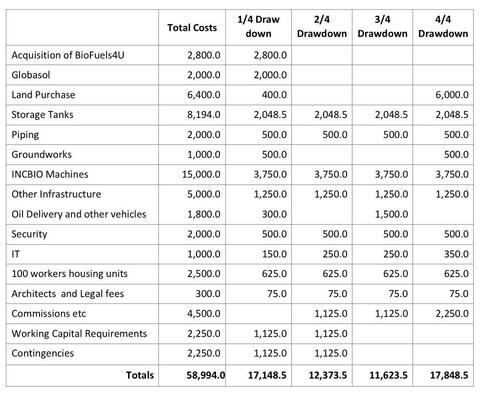

Caribbean Biofuels Ltd. is seeking an investment totaling US$58.994 million, to be drawn down over four quarters (see Table 5), to fund the purchase and expansion of a facility for the production, storage, and blending of biodiesel in the Dominican Republic. The planned development will be in three stages (see Table 2 for an outline chart of activities), building on pre-investment discussions and agreements with prospective partners concerning the acquisition of land and construction of the plant. It is aim to become a net exporter of biodiesel within five years and to be an exporter of refined glycerin within two years of commencing operations.

Stage 1: We have signed a Letter of Intent with the principal to purchase the small Dominican Republic company BioProducts4U, which has acquired the relevant Government licenses and permits needed to import and sell fuels in the Dominican Republic. We will seek to purchase the company Globasol, which also has requisite licenses and permissions, although not operating currently.

Cost US$4.8 million

BioFuels4U owns land and fuel storage facilities at the port of Pepillo Salcedo and in Santiago. It operates from a free zone in the Santiago area, in which there are no import duties to be paid, and has been trading for 5 years. This company has been unable to grow due to a lack of experienced management and financing. Caribbean Biofuels Ltd. plans to significantly increase output for this facility.

The company has all of the permissions and permits required to export fuels, import first-generation agrofuel feed-stocks, and produce, store, blend and distribute biofuels. This provides an immediate vehicle for the sale of biodiesel to existing clients. This subsidiary, under the direction of our sales force, will focus on the Freezone areas of DR and build on its existing client base.

Caribbean Biofuels Ltd. has selected the Portuguese company IncBio (http://www.incbio.com/) as the preferred builder of the biodiesel production facility. They have provided an outline proposal for a plant with an output capacity of 180,000 metric tons per annum, complete all requisite storage and pipework, with glycerol refinement and methanol reclamation units. This firm will construct the facility and train local staff and provide ongoing consultancy. The pricing schedule for the construction of the biodiesel plant only (excluding all other work) is attached as Appendix 1.

We have asked Monolithic Dome Institute for plans for the construction of the tank farm, including all storage containments that are designed to withstand hurricanes and earthquakes.

To ensure continuity of operation, the facility will be provided with electricity produced by generators operating on biodiesel produced by the plant. Also, the plant will have inbuilt redundancy to ensure that potential unit downtime is minimized, and that continuity of production will be maintained. The facility will be secured by local contractors under the supervision of one of the Directors, who is a security specialist.

Cost US$ 37.594 million

As required by the law of the Dominican Republic, the company will construct accommodations for staff employed across the whole operation. In addition to quotes received from local contractors, we have approached the US company Gigacrete for a proposal. Part of the social housing project will include recreational facilities for staff, comprising baseball and soccer pitches and a volleyball court, with seating for spectators. It will include also a local school project to create an animal shelter to educate children on animal welfare.

Cost US$ 2.5 million

Stage 2: While the processing plant is under construction, the company will engage with one or more oil trading companies to create a staged and continuous supply of D2 diesel for blending. We shall also employ three oil traders to create the necessary structures for trading diesel and biodiesel to initiate an ongoing US$ revenue stream.

Stage 3: Caribbean Biofuels Ltd. has agreed with the owners the purchase of 500 hectares of agricultural land in the Monte Cristi region close to the port of Pepillo Salcedo (see Figs 1 and 2 above), which will become the import/export and manufacturing hub for the operation. In addition, the company will lease a further 3500 hectares of agricultural land in the center of the country. Sr Hector Rivera of Rivera Suministros SRL (www.RiveraSuministros.com) is acting as an agent for the various landowners and will be a key partner in an ongoing development program of farming of oil stock crops. In Fig. 2, the existing Biofuel4U tanks can be seen on the site where our processing plant will be constructed.

The majority of the land will be used for the growth of first-generation agrofuels/energy crops on a four-year rotational cycle from the start of Stage 3. On this land, an area of 20ha will be set aside for the construction of production and storage facilities, offices and housing for workers.

Cost of land purchase and 1st year rent US$6.75 million

Table 2 – Breakdown of land use (hectares)

Biofuels plant 9ha

Storage tanks 2ha

Workers’ housing project 4ha

Port facilities 5ha

Oil crop cultivation 3880 ha

Agrofuels are derived from a whole host of crops including maize (corn), soya, canola (rapeseed), sugarcane, cassava (manioc), plantain, sunflower, palm, coconut, jatropha, and castor, among others. The initial crop for the DR will be rapeseed from 2016. We will use the local farming expertise, provided by Rivera Suministros, to initiate the planting, maintenance, and harvesting of rapeseed as the initial energy crop. This crop requires rotation in a four-year cycle, we estimate an initial median oil yield of 3 metric tons per hectare, providing approximately 3000 metric tons per year for each of the first 4 years. Other crops may be considered after the 4 year period depending on the research.

As part of the development, the company will have in place a crushing and filtering facility to process the oil crop and storage containers for the raw oil. The company has identified further areas that would be suitable for acquisition and cultivation once production based on imported oil is fully operational. The company will progress towards a target of 10,000 metric tons within five years.

The company will also seek to encourage farmers in DR to grow oilseed, again with a long-term view to moving the country in the direction of self-sufficiency, as well as lowering the cost of feedstock for the operation. CBL will select energy crops grown on marginal land - that do not compete directly with food crops for land or cause indirect Land Use Change, hence the agrofuel will be from sustainable feedstocks.

Fig. 1 North-western Dominican Republic showing the location of Pepillo Salcedo (middle left) and Santiago de los Caballeros (bottom right).

Fig. 2 The port of Pepillo Salcedo, showing the oil terminal (top), and existing storage tanks (bottom right) in the area on which the biofuel plant will be constructed.

3. Summary

By the end of Stage 3, at the end of 2016, there will be a biofuels production plant producing 1200 metric tons of biodiesel and 120 tons of refined glycerin in the first twelve months of operation, ramping up to in excess of 40,000 metric tons of biodiesel and 4,000 tons of glycerin in Years 2 and 3 (see Tables 5 and 6, Financial Projections, below).

Table 3 – Breakdown of expenditure in US$ millions

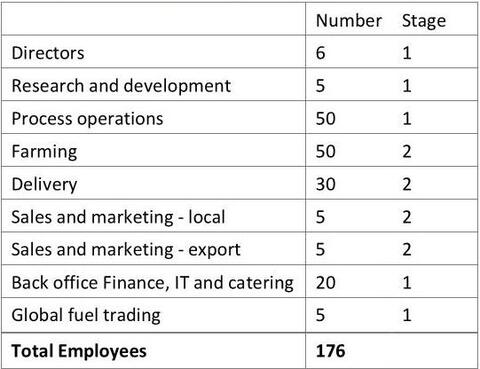

In the first three years, operations will require a total of 176 permanent staff in the various areas (Table 4). In addition, 100 temporary construction jobs will be created.

Table 4 – Workforce requirements

4. Company Structure and Directors

Caribbean Biofuels SRL is a wholly owned subsidiary of Caribbean Biofuels Ltd., a company registered with the United Kingdom authorities (company registration number 09401127). Caribbean Biofuels Ltd. will be the owner of Biofuels4U SRL when a purchase is complete.

The company banks with Lloyds of London in St James, and in the Dominican Republic with Banco Popular Dominican Republic in La Romana, and will use London as the financial operating center for the project.

The company directors and senior management are:

CEO and Board Chairman Industry search for the right appointee in the process

Juan Nolasco – Chief Technical Officer/Technical Director

Juan is a qualified industrial engineer with oil experience and holds a Master’s Degree in Engineering. He has detailed knowledge of the operating environment in the country and has strong contacts with the relevant government bodies and relevant stakeholders. Juan has special competence in the areas of plant operations, quality control implementation systems, plant layouts and restructuring of operation projects, cost-saving, re-engineering and reorganization projects, personnel management, project evaluation, and pay and incentives implementation. Juan was a Member of the Dominican Olympic Team (Rifle Target) and is a member of the Dominican Golf Federation and of the American Chamber of Commerce of DR.

Major David Jones – Head of Security

Major Jones served with distinction in the Parachute Regiment of the British Army, and since leaving the service has acted as a security consultant. He has also spent many years working as an oil trader and will head up the oil trading and materials procurement operations.

Dr. Brian G. Scott – Chief Operations Officer

Brian was originally an archaeological scientist and metallurgist, who held a senior management position in the Northern Ireland Civil Service. Having taken early retirement, he worked as a cryptographic consultant for a startup developing digital rights management software, which was sold to VisionGateway, a company listed on NASDAQ. He worked with Richard Ainsworth-Morris on a project to manufacture biodiesel in Northern Ireland, which had to be abandoned because of the unsafe security situation surrounding the sale of diesel in the Province. He has worked as a consultant for the Environment and Heritage Service of the Northern Ireland government, and as a freelance consultant on major heritage infrastructure projects.

5. Financial scheduling and Projections

The funding of the schedule of works and development over the first three years is shown in Tables 5–7 below.

The conservative financial projections are based on growth in all operating areas, although the energy generation sector is not taken into account here. To these, we add the following notes:

- Biodiesel production will increase significantly once retailers realise there is a producer on the island. However, it is more prudent to show lower volumes for the time being.

- Full-scale production will allow for exports to other Caribbean islands and other parts of South America.

- Depreciation has not been taken into account for EBITDA, as it does not affect cash profits or cash at the bank.

- Interest receivable has also been ignored as a conservative measure.

- Operations will be on a free-zone basis since currently there is no tax on profits or levy of VAT for free-zone operations. There is a 10% tax on dividend distributions for free-zone corporations.

- Year 1 administrative operating costs are net of items being capitalized under IASB.

Table 5 Financials Year 1 (US$)

Appendix 1 – Incbio specifications for the biodiesel production plant

a. Technical Certificates and Regulations

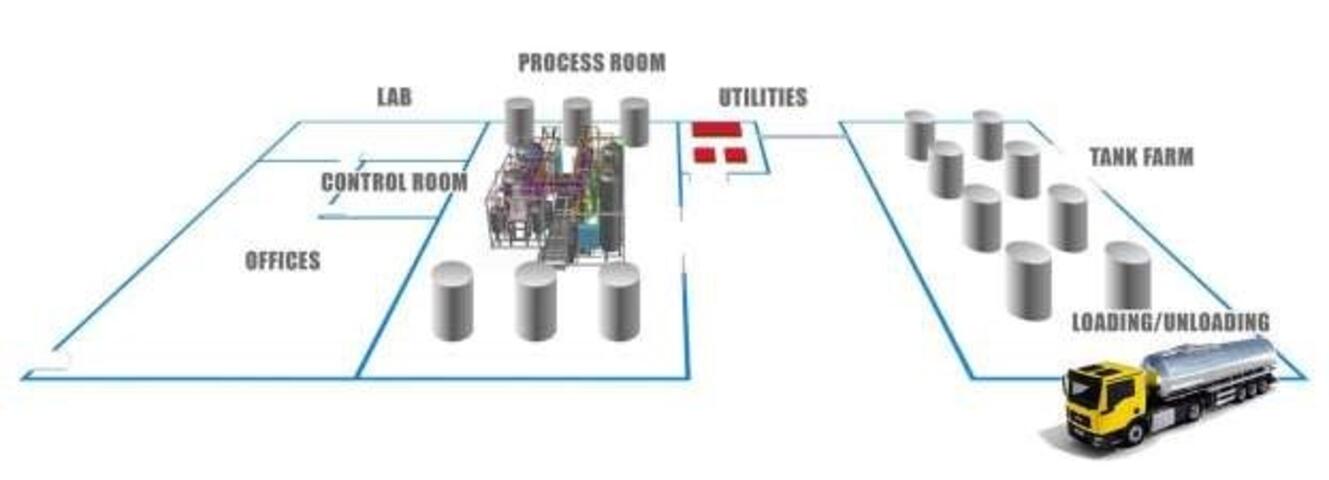

The plant will be fully tested by Incbio and will be CE marked to demonstrate the manufacturer’s compliance with European directives. Furthermore, the plant will be fully ATEX Explosive Atmospheres Regulations (Directive 94/9/EC – ATEX) compliant, whilst all electrical components will be ATEX certified. All technical rules regarding pressure tanks, piping, plant assembly, and installation will be complied with by Incbio. b. Plant layout example

In this example of a plant layout, the following major structures can be observed:

A Tank Farm, with loading and unloading capabilities (for trucks only, or for trucks and/or trains and/or boats).

Utility room

Process room, with INCBIO processing equipment, and optional feedstock and biodiesel processing tanks

Control room, with INCBIO computers, with SCADA to control processing equipment Laboratory, with optional testing equipment Offices

Essential utilities (not included, that can be quoted, upon request) are:

hot oil – Using diesel, biodiesel, or gas boiler

Cooling water – From storage tank or Chiller (depending on location)

Compressed air – From the compressor

Nitrogen – From the Nitrogen generator

Electricity

Fire suppression system

c. Scope of Supply

Incbio’s scope of supply of the present proposal is the following: Know-how, basic and detailed engineering

Equipment and machinery complete with motors as described previously.

Field instrumentation.

Power control panel MCC.

Process and utilities piping and valves.

Electric and instrument cables

Computer control system, including hardware, basic and application software, interface to the plant, and operator interface.

Interconnecting pipes between the various Incbio’s process plants

All Lubricants and fillings, including initial filling (except for resins)

d. Work Not Included

The following supplies and services will be excluded from Incbio’s supply:

Erection including all mechanical and electrical connections

Steel structures

Thermal insulation and tracing materials

Interconnecting pipes between the various process plants and between the process plants and utilities

Civil works of any kind, such as soil investigation, excavations, foundations and anchor bolts, buildings, channels, drains, masonry, grounding, steel structures, pipe supports, gangways including design, etc.

All permitting activities

Storage facilities for raw materials and finished products as well as for fuel oil, etc.

Final painting of buildings

Electric power supply, power transformer, distribution stations, electrical equipment such as cables and cable trays required outside the process equipment

Lighting installation required inside and outside the process building

Lightning equipment and fire-fighting equipment, as well as any safety equipment required by local authorities and/or laws

Production and distribution of utilities outside the battery limits of the plant(s) except for those expressly quoted

Storage and handling of various products, chemicals, and auxiliary materials outside battery limits, unless otherwise specified

Spare parts

Any safety device of any kind required by local authorities, and/or insurance companies stricter than regulations

e. Plant Commissioning, Start-Up, and Training

In this proposal, on-site support of the commissioning and start-up activities are not included. This training can be done with the client’s staff at our facilities in Portugal. Start-up at the client’s facilities can be arranged, and quotation upon request. If only supervision of the installation and startup activities is required INCBIO shall provide Engineers to this effect, charges shall be as per the hourly wage table outlined in Annex I.

f. Documentation

All engineering documents will be in the English language, using the metric system.

Incbio will provide an Installation, Operation, and Maintenance Manual for the system (1 electronic copy). The IOM Manual will include the following:

- Operating Instructions

- Equipment DocumentationSpecification sheets

- Drawings

- Spare parts lists

- Manufacturer IOM manuals Test reports (i.e. hydro test reports, data sheets)

- Instrumentation Documentation

- Specification sheets

- Spare parts lists

- Manufacturer IOM manuals

- P&ID drawings

- Module layout drawings

- Instrument loop drawings

- Junction box drawings

- Electrical drawings

- Utility table

A complete physical set of documents can be provided on request.

g. Factory Acceptance Test (FAT)

A factory acceptance test (FAT) will be performed at Incbio prior to shipping of the system. The client is welcome to witness any of the FAT tests. The FAT will consist of the following:

Hydro test of each tank and exchanger as per the specifications;

Inspection of the modules, all equipment, and instrumentation to confirm they conform to the P&ID and equipment and instrument specification sheets;

Inspection of the modules to confirm they conform to the P&ID’s and layout drawings.

h. Warranty

All of Incbio’s equipment comes with a 12-month manufacturer’s warranty against defects in design, workmanship, and materials, counting from the date of commissioning, or 18 months counting from the date of shipment, whichever is soonest. Details on this warranty shall be covered on a separate document to be included in the Sale Agreement.

Commercials

a. Price

Our budget price for providing all the services as described in this proposal for a 540TPD system (22.5MT/hour), with input feedstock with up to 25% FFA, 200 ppm H2O, comprising of:

Degumming and Bleaching

Acid Esterification and Transesterification

Methanol recovery from all streams

Glycerine Treatment

Methanol distillation

Biodiesel distillation

11.800.000 EUROS (Eleven Million and Height Hundred Thousand Euros), Ex-works Incoterms 2010.

b. Payment Schedule

With the order: 20% T/T as a down payment.

Upon submission of layout drawings and P&ID for approval: 40% T/T

Upon completion of the commissioning and FAT, before shipping: 40% T/T.

c. Payment Terms

The first payment is due with the order, all other payments are due Net 7 days after the achievement of the given milestone. If the Client does not fulfill the terms of payment set out above, INCBIO may suspend the performance of its services until such time as the Client has complied. This shall not affect any other remedies available to INCBIO, including but not limited to legal action. d. Taxes

The price excludes any and all taxes and/or duties, up to the moment the title to all Equipment supplied by Seller shall pass to Buyer. Any taxes and/or duties due in the Buyer's country are not Seller's responsibility.

e. Schedule

The complete system will be ready for delivery 52 weeks from receipt of the down payment and all approvals. The schedule requires drawing approval in less than 1 week, each day that an approval drawing is late will add to the overall schedule.

f. Transport and Installation

Shipping and installation is not included in this proposal. It can be carried out according to our hourly wage rate, or by quotation upon request. g. Proposal Validity

This proposal is valid for 60 days.

Annex I - Hourly Wage Rates, Travel and Accommodation Expenses

Hourly wage rate (Values in EUROS - VAT not included): Category Price/hour

A1. Department directors; Project Director; Specialist Engineer; ................................77,50

A2. Project Leader; Head of Discipline; Senior Engineer; Senior Architect; ..............60,00

B1. Architects; Engineers; Superior Technicians; ..........................................................52,50

B2. Architects; Engineers; Industrial Technicians; Contract Managers; Technical Translators;. .....................................................................................................................43,00

C1. Junior Engineer; Junior Architect; Senior Designer; Planning Technician; Cost Control Technician; Procurement Technician; Inspectors; .......................................................35,00

C2. Junior Engineer; Junior Architect; Designers; Measurers; Planning Technicians; Cost Control Technician; .........................................................................................................28,00

D. Trainee Engineer; Trainee Architect; Designers class 1; .........................................26,70

E. Designers class 2; Bilingual project Secretaries; .....................................................24,00

F. Designers class 3; Project secretaries; Auxiliary Staff; Document Controllers; Dactylographer;...........................................................................................19,00

Project Risk Assessment

Introduction

The Spanish-speaking Dominican Republic occupies approximately 60% of the eastern part of the Caribbean island formerly known as Hispaniola, in the chain of islands known as the Greater Antilles, the remainder to the west being the territory of the Republic of Haiti. The country has a democratic system of government, with the Executive formed by an elected president and the cabinet that he appoints, and a bicameral organization of the Senate and Chamber of Deputies; the judiciary is independent of the political organization.

Post-war, the country has experienced political turmoil and economic instability, military dictatorship and civil war, and US military and political intervention. Following the presidency of Joaquín Balaguer, during which elections in 1990 and 1994 saw considerable electoral fraud and violence, the presidencies of Leonel Fernández and Hipólito Mejía in the latter part of the decade and 2000s saw political stability, but several periods of economic problems. Further, serious corruption (the Dominican Republic currently has a score of 32%, where 100% means free from corruption[1]) precipitated the collapse in 2003 of three major banks[2], and remains a feature of official administration today. The current president Danilo Medina has waged a campaign against corruption and has introduced tax reforms, including a rise in VAT rates, to reduce the budget deficit. He holds office until 2016. An analysis of the current political situation in the country by our company lawyer Sr Jorge T. Vilorio is attached as Appendix 1.

At the start of 2015, the population of the Dominican Republic was 10.6 million,[3] with a youth literacy rate averaging 97% for males and females.[4] While education standards in the past have been criticized, based on inadequate early schooling standards, the government introduced a number of initiatives to improve matters, pointing to the 10-year initiative for university education.[5]

Historically, the country has relied heavily on exporting sugar, of which it is a major producer, and increasingly on tourism and the service sector in general. A broad-brush analysis of the strengths and weaknesses of the economy highlights improvements in government performance with regard to the economy but notes also the very poor performance of the energy generation sector, the weakness of foreign exchange reserves, and exposure to uncertainties of the deteriorating political and economic situation in

[1] http://www.tradingeconomics.com/dominican-republic/corruption-index[2] see, for example, https://www.wikileaks.org/plusd/cables/04SANTODOMINGO5952_a.html[3] http://www.tradingeconomics.com/country-list/population[4] http://www.unicef.org/infobycountry/domrepublic_statistics.html[5] http://www.seescyt.gov.do/plandecenal/docsplandecenal /Plan%20Decenal%20ES%20Completo%20Imprimir.pdf

Venezuela, which currently supplies the majority of oil imports, subsidized by low-interest loans.[1] However, on the back of the Fitch Rating being raised to B+ in November 2014, a sale of US$2.5 billion in bonds in January 2015 to reduce sovereign debt has been welcomed by the markets as there is growing confidence in the underlying strength and stability of the economy.[2]

Caribbean Biofuels project to establish biodiesel production in the Dominican Republic Strengths

1. there is no competition. One company currently imports biodiesel for blending with imported fossil fuel; Caribbean Biofuels Ltd. has signed a letter of intent with the owner to purchase it. The company already has all of the permits required for the establishment of biodiesel production and so Caribbean Biofuels Ltd. can progress to the development phase almost immediately;

2. importing diesel fuel for road haulage, energy generation, and private transport keeps prices high. Locally produced biodiesel blended with imported fossil fuel will allow for a reduction in prices, while still allowing the company to maintain a competitive edge. The government of President Medina is actively encouraging initiatives to reduce dependence on foreign imports and is keen to see new, practical ways[1] of supplying transport and energy generation requirements. One of our directors, Juan Nolasco, has strong contacts within the Energy Ministry, and the positive economic effects of our activities will be welcomed;

3. an educated workforce. The basic requirements of labor can be met by the local population, which provides a pool of workers keen to learn and earn, and who can be readily trained (see notes 3 and 4). Agreement with IncBio to train middle and junior management and staff through Spanish will speed up the process of getting the plant safely operational prior to final commissioning;

4. cooperative unions. Trade union activities are moderated by a genuine desire to achieve the right balance between ensuring the best conditions for their members and maximum profitability for the company, to safeguard long-term employment;

5. a favorable tax regime. Caribbean Biofuels will be operating in free zones established by the government specifically to attract inward investment by applying a favorable rate of business tax;

6. presence of major multinationals makes for a benevolent trading climate. Multinationals that have operating presences in DR include Nestlé, Proctor and Gamble, Imperial Tobacco, and Deutsche Bank.

[6] https://economics.rabobank.com/publications/2014/february/country-report-dominican-republic/ [7] http://www.bloomberg.com/news/articles/2015-01-20/dominican-republic-plans-to-issue-at-least-1-billion-ofbonds. [8] Wind is impractical due to the need to suspend operations during the hurricane season which lasts from approximately June to November, the potential for hydro-electric is limited, and in 2011 a biomass project for the Monte Cristi region failed due to impracticalities.

Weaknesses

7. lack of local senior management for project development. Senior management and project directors will have to be brought in to bring the planning, construction and commissioning of the plant to fruition;

8. reliance on imports; The operation will have to rely on continuing imports of D2 diesel, for blending, on processing reagents for conversion of feedstock to biodiesel and, in the medium term, on feedstock for processing;

9. lack of experience in local agriculture in dealing with feedstock plants other than palm oil. The company has plans to reduce dependency on imports of unrefined rapeseed oil as rapidly as possible by growing rape on an initial tranche of land tended by tenant farmers. We will need in the first instance to recruit expertise, probably from either the US or India.

Opportunities

10. potential for rapid expansion of sales. By being first-in-market and with a clear strategy for exploiting this advantage, we can effectively corner the market for reduced-price biodiesel blends road haulage, transport, and private motoring in a short space of time with distribution through the purchases of filling stations throughout the Republic;

11. moving into supplying the energy-generating sector. It is widely recognised that the inefficiencies of the energy-generating sector are due, in part at least, to the comparatively high cost of imported diesel, and President Medina is actively encouraging measures to improve the situation.[1] The opportunity arises for Caribbean Biofuels to enter into an agreement with one or more of the utility companies to finance the conversion of their generators to run on high percentage biodiesel/fossil diesel blends in return for long-term contracts for supply;

12. refined glycerol. A by-product of the transesterification process is glycerol, which has a wide variety of commercial uses from the production of animal feed to cosmetics. The company has agreed on a specification with IncBio (the company that will manufacture all processing plants) to include in the specifications a line to refine glycerol as a part of the routine running of the plant;

13. trading operations. As part of the company strategy to ensure continuity of supply of D2 diesel for blending through the establishment of a small trading arm to be based in Switzerland, it is anticipated that once in operation, this will generate an additional revenue stream to increase the profitability of the company overall.

[9] see Appendix 3

Threats

14. increasing instability in Venezuela. Since the death of Hugo Chavez, the administration of President Nicolas Maduro has proved incapable of improving the economic situation, with the result that there is significant unrest and pressure from the grassroots up. Given the existing hostility of the US conservatives to Venezualan socialism, the election of a right-wing Republican president in 2016 could lead to policies that would bring about instability resulting in disruption of the current major supply of D2 diesel;

15. continuing instability in the Middle East. Coupled with a reduction in, or even loss of Venezuelan supplies, further turmoil in the spectrum of oil-producing countries could force prices up, reducing the profitability of the operation. However, in both scenarios we would envisage the operation of the trading arm to provide an efficient and effective buffer;

16. potential adverse effects of TTIP. The signing of the Transatlantic Trade Investment Partnership[1] between the US and the EU could make it more difficult for the company to export to the US, as biodiesel producers in the EU have a strong voice in Brussels through FEDIOL, the organization representing the European Vegetable Oil and Protein meal Industry[2], which would be in a position to lobby for tariff barriers against non-EU imports of biodiesel and/or glycerine. Similarly, the US National Biodiesel Board,[3] which represents the interests of the industry there, has a lobby center in Washington D.C. and seeks to influence the policies of the Administration on the promotion of the biodiesel industry in the US. It is not inconceivable that one result of TTIP could be the creation of a trade zone closed to biodiesel and glycerol from non-TTIP participant countries;

17. natural disasters. The Dominican Republic has a regular hurricane season during which there is a potential danger of loss of life and structural damage. Since 1960, there have been major destructive hurricanes in 1963, 1964, 1966, 1979 (Hurricane David, which killed over 2000 people and caused major damage in the south of the island), and 1998 (Hurricane George, which killed over 1000 people, caused major flooding and structural damage).[4]

The island is also prone to earthquakes, most notably the major disaster in Haiti in 2010 when a shock of 7.0 on the Richter scale caused an estimate 160,000 deaths directly and indirectly and major destruction of infrastructure, the effects of which are still being felt. The culprit is the Enriquillo fault system, and although this runs primarily through the south of Haiti, its return to a seismically active state[5] indicates the possibility of a major shock that could affect the Dominican Republic.[6]

The company has included in its plans a provision for the construction of plant and storage facilities that are proof against all but most major hurricane and/or earthquake events using the latest available technology.

[1] http://ec.europa.eu/trade/policy/in-focus/ttip/[2] http://www.fediol.be/web/fediol/1011306087/list1023110705/f1.html[3] http://biodiesel.org/[4] http://www.dominican-republic-live.com/dominican-republic/weather/hurricane-history-dominican-republic.html[5] For a list of recent seismic activity in the region of 3-4 on the Richter scale in DR, see http://earthquaketrack.com/p/dominican-republic/recent[6] http://woodshole.er.usgs.gov/project-pages/caribbean/pdf/Haiti_historical_EQ_BSSA.pdf

18. political instability in the Dominican Republic. The political situation has been stabilising since the late 1990s. However, in the unlikely event that the 2016 election returns former President Fernandez, there is the potential for problems, given his alleged involvement in corruption, including links to the convicted drug trafficker Quirino Ernesto Paulino who claims to have given Fernandez some US$4.6 million between 2002 and 2004.[1] Paulino agreed on a deal with US prosecutors for a reduced sentence in return for testifying in future cases. If federal prosecutors cite a newly elected President Fernandez on charges of facilitating drug trafficking, the inevitable diplomatic problems would initiate a period of political instability inside the Dominican Republic, with subsequent economic consequences in terms of trade.

Conclusions

The project represents a significant capital investment in a region in which there is always a degree of political and economic uncertainty. This, coupled with the potential for significant disruption due to the forces of nature, presents a spectrum of risks that is not inconsiderable. Against this, apart from natural disasters, most of the risk is mitigated by the project planning and forward look of the company.

[16] http://www.theguardian.com/world/2015/feb/19/dominican-republic-drug-trafficker-donation-leonel-fernandez

Currently, these are the main political officers in power:

DANILO MEDINA SÁNCHEZ – Constitutional President until 2016 (2012-2016);

DANILO MEDINA SÁNCHEZ – Constitutional President until 2016 (2012-2016);

MARGARITA CEDEÑO DE FERNÁNDEZ – Vice-President until 2016;

CRISTINA LIZARDO – President of the Senate

ABEL MARTÍNEZ – President of the Chamber of Deputies

MARIANO GERMÁN MEJÍA – President of the Supreme Court of Justice

APPENDIX 3: L E G A L – POLITICAL REPORT

For: Dr. Brian Scott, PhD & Richard F. Ainsworth-Morris

From: Jorge T. Vilorio

Date: 2015-06-24

Ref: Outline of Political Elections in the Dominican Republic for May 2016.

The present Report is intended to briefly summarize the ongoing forecasts, statistics, and relative matters concerning the presidential, congress, and municipal elections for the upcoming presidential period of 2016-2020 in the Dominican Republic.

For the purposes of having a better comprehension of the facts hereinafter, we will initiate by analyzing the current political scenario of the Dominican Republic, summarizing our local government structure, following by the proposed candidates for each political party, the different polls ran by firms like Gallup and Penn Schoen & Berland and finalizing with a swift opinion-analysis concluding based on these outcomes.

- Political Structure of the Dominican Republic

The government of the Dominican Republic consists of a representative democracy, whereas the political figure of the President is vested with the authority as head of state, and head of government, and the legislative power is run by a multi-chamber Congress composed of the Senate (Senado) and the Chamber of Deputies (Cámara de Diputados). The Judiciary is ruled by the Supreme Court of Justice. Former Article 124 of the Dominican Constitution of 2010 established that the President-elect cannot serve for a following consecutive term, however, as per the previous Constitutional reform during the past weeks this article now allows the following reelection (as used in the United States electoral system).

Consequently, there are three (3) main political parties, one of which went through significant turmoil, and thus a fourth political party was created. These are the following: (I) Partido de la Liberación Dominicana (PLD), led by Leonel Fernández Reyna; (II) Partido Revolucionario Dominicano, led by Miguel Vargas Maldonado; (III) Partido Reformista

Social Cristiano (PRSC), led by Federico “Quique” Antún Battle, and (IV) Partido Revolucionario Moderno, led by Andrés Bautista García. Before the presidential election, each political party must choose their running candidate; so far, they are:

For PLD there is still no candidate chosen; however, the party members running for president are Leonel Fernández Reyna (ex-president of the Dominican Republic); Reinaldo Pared Pérez (Senator), Temístocles Montás (Minister of Economy), Francisco Javier García (Minister of Tourism), and Danilo Medina Sánchez (current President of the Dominican Republic);

For PRD the candidate is Miguel Vargas Maldonado; For PRSC there is still no candidate chosen; For PRM the candidate is Luis Abinader.

Leonel Fernández formally announced his candidacy for the presidency during the beginning of 2014. He was president of the Dominican Republic in the periods of 19962000, 2004-2008, and 2008-2012, for a total of twelve (12) years in power. He left office with a public debt of over DOP 153,000,000,000.00 in 2012 due to a series of corruption scandals led by himself and his government officials. To date, there is not a single successful prosecution against him or any of his officials. His popularity, however, was relatively good, until last year.

During Fall of 2014, the Attorney General (Procurador General de la República), Francisco Domínguez Brito, formally filed a complaint against the Senator for the Province of San Juan de la Maguana, Félix Bautista Rosario, and other presumed felons who allegedly embezzled over US$170,000,000.00 from a construction loan agreement with the

SUNLAND GROUP CORP., as well as other administrative corruption charges. The case went over a few months and ended with a judge ruling in favor of Félix Bautista and the other felons, having an acquitting decision and causing great critique in the Dominican society.

There is an appeal to this decision, however, chances are the judgment will no

However, after this case, Leonel Fernández’s popularity went down by significant points, which we will see based on governmental polls ran through the beginning of this year.

- GALLUP DOMINICANA; PENN SCHOEN & BERLAND

Two (2) main polling firms prepared political predictions based on popular opinions starting this year. These polls, however, should not be held as very reliable, due to the fact that the companies sponsoring them may be inclined to one political party or another.

GALLUP DOMINICANA, FEB. & JUNE 2015

These were the average results for GALLUP DOMINICANA: Danilo Medina 50.6%; Leonel Fernández 30.4%; other candidates were lower.

A lot is said about GALLUP DOMINICANA, so the reliability of this poll should not be rendered as 100% true.

PENN SCHOEN & BERLAND, MAY 2015

After a series of polls in the start of 2015, last May this firm concluded that Danilo Medina Sánchez would win a presidential election against any candidate and thereby the poll issued in May had excluded him from the options. These were the results:

Luis Abinader: 34%

Leonel Fernández: 32%

We can conclude by stating that for the moment Danilo Medina is a promising candidate for the next presidential election.

III. RESIGNATION OF GOVERNMENT OFFICIALS AFTER THE AMENDMENT OF THE DOMINICAN CONSTITUTION.

After Danilo Medina’s declaration of pursuing the modification of Article 124 (re-election) of the Dominican Constitution, the Castillo family was reluctant to accept this position. They are, to date, fully opposed to his presidential re-election, and they demonstrated it by an act of resignation of their respective government positions. The Castillo family are head of a mildly significant political party called FUERZA NACIONAL PROGRESISTA (National Progressive Force) or “FNP”, which is a small, traditional party instituted in the 60s after the fall of Rafael Leonidas Trujillo.

Marino Vinicio (Vincho) Castillo, head of the Castillo family and FNP, was the director of the Governmental Ethics Directorate, and he resigned of this position very recently. His son, Marino Vinicio Castillo Semán, is a member of the Chamber of Deputy and a well-renowned lawyer in the Dominican Republic, and he too resigned from other political functions. Moreover, another son of Vincho’s, Pelegrín Castillo Semán, resigned of his position of Minister of Energy and Mines.

After Pelegrín Castillo’s resignation, the newly appointed Minister, Mr. Antonio Isa Conde, revealed a series of financial and accounting irregularities in the Ministry’s statements, especially concerning salaries and payments without any type of leverage or support, for an amount scaling DOP 10,000,000.00. To date, Mr. Castillo hasn’t given any explanation for this occurrence. However, the newly appointed Minister seems to have the intention of regularizing the situation. Also, the Director of the Migration Offices, José Ricardo Taveras, also a member of the FNP, resigned to his position and he too left huge debts revealing obscure budgets and accounting irregularities.

- CONCLUSIONS

The fight against corruption is far from successful at the moment. However, Danilo Medina’s presidential period has introduced significant reforms to the governmental situation of our institutions and public policies. His work reveals a mild intention of restructuring public debt and developing many areas of society. He has remodeled public hospitals like the Darío Contreras, he has instituted a whole new 911 system, which has had positive results so far. He has controlled spending in some institutions, such as the Ministry of Public Works, which now develops each government road and construction under the financial control of a public escrow account as per Fiduciary Law No. 189-11. He has also removed various public officials from their respective positions and replaced them with well-renowned members who have demonstrated no danger at the moment.

Energy-wise, he has agreed to develop carbon-based power plants with Dominican Power Partners, a company belonging to the AES Group, thus intending to reduce the electrical deficit and difficulties. He has engaged in various international treaties for sustainable development and is currently negotiating free trade agreements with Latin American nations such as Chile and Colombia. Also, his humanitarian work has earned him great approval from all sectors of Dominican society. People are longing for yet another presidential period of his mandate, which is why he has a solid opportunity for the next elections.

Jorge T. Vilorio