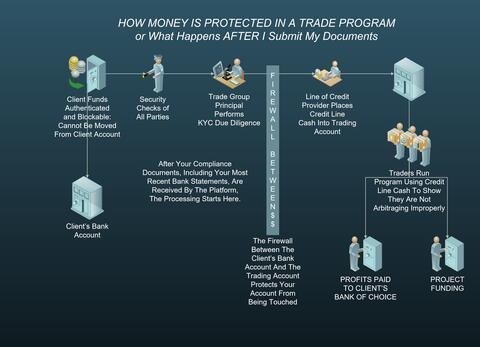

Program Deposit Protection

There is a misunderstanding amongst some people who do not understand what an MT760 does. The MT760 is a full bank responsibility hold on the funds. They STAY in the investor's account at the investor’s bank. They retain ownership of the money. Another use of the MT760 (it has dual purposes) could be the actual transfer of an asset from one bank to another— however that is NOT the use being used by the platform trading group. Besides, in the US a transfer of cash is done via an MT103, not MT760, and an MT542 is used to block funds.

The trader cannot do his buying and selling unless he has confirmation that the client’s funds are in place at the moment he makes his trade. That is why the MT760 is required. EXCEPTION: Funds that are in HSBC or Standard Chartered DO NOT REQUIRE A SWIFT. They are administratively blocked at the bank.

From a practical matter, the trader only purchases paper (and incurs a liability) when they have a ready buyer standing by to take the newly issued paper immediately and close the transaction. The trader is compensated on his or her performance by executing the buy and sell transaction at a profit. Therefore, it does not make any sense for them to order paper unless they have the buyer lined up.

Investor Deposit Security

Frequently Asked Questions.

What type of catastrophic event befalling the Trader or his Trading Program could create a situation in which the client's deposited funds MIGHT be at risk?

One scenario for something cataclysmic would be an entire collapse of the world banking system as it currently operates. This would mean the globe would be thrown into complete disarray, which would probably mean civil wars in a number of countries when people can’t get their money to buy food, clothing, shelter, and the other necessary items needed becoming scarce as the supply chains run dry because manufacturers, farmers, and other commodity producers could not access their cash to pay for their businesses. In other words, a complete destruction of the banking system and the effects it would have on everything from trading to basic life existence.

A lesser scenario might be the inability of the trader to get the paper he needs in order to resell it to the various other regulated buyers of paper, thus turning a profit. This would create a vacuum for the trading business. However, if the trader cannot buy paper, he simply doesn’t execute the order. That means a net-zero impact with no impact on the investor deposit account.

As long as pension funds around the world are buying trillions of Dollars’ worth of paper on a regular basis to put into their portfolios to keep their pension obligations earning their necessary minimum interest, then the system of buy/sell continues. Absent a catastrophic collapse on a global scale, I can’t realistically imagine an investor's deposit being at risk. We are dealing with paper issued by the top 10 western European banks, which creates debt through the issuance of this paper and supports the world economy.

The above applies to the information below

This is a method of securing funds to purchase a business whether you are an individual or an existing company. The process is quite complex and not everyone succeeds. The example here is a disrupted manufacturing company which we worked where we managed to secure 150,000,000 USD Standby Letter of Credit originated two years ago and is just only going through.

Another use for a standby letter of credit is to sure up company balance sheets in the medium term or to provide the supplier with evidence there is a convertible financial document enabling the supplier to supply the goods against an SBLC. The same can be said of Bank Guarantees.